It will also need to be updated every now and then.

#PERSONAL CAPITAL VS QUICKEN SOFTWARE#

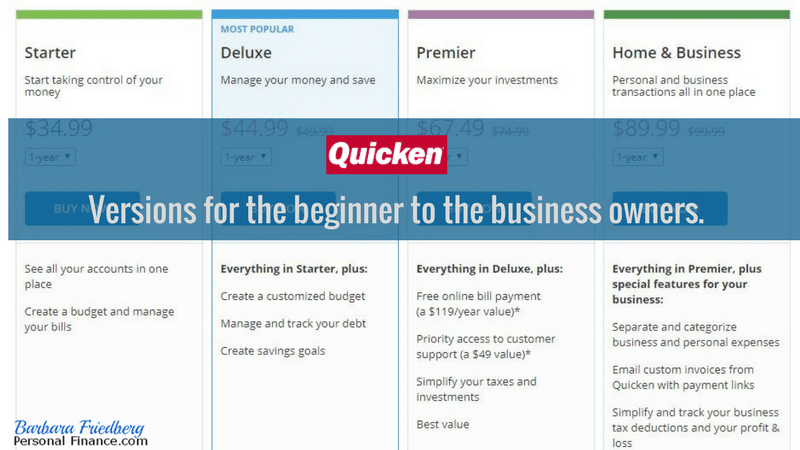

You’ll be able to track your expenses, manage your bills, write a budget, and more.īecause Quicken is a software program, you’ll need to download it to your computer. Quicken allows you to connect all of your accounts in one place. They’ve learned over time exactly what users are looking for to stay connected to their money. The good news is that this long track record has given them an opportunity to learn what users really want from a personal finance program.įor over 30 years Quicken has been helping people keep their finances organized and in one place. Hopefully, this will help you decide which financial tool is best for you. Today, I’m breaking down the difference between Quicken and Mint. And once we knew more about our spending habits, we were able to make serious progress on our money goals! It wasn’t until we chose a program that worked for us that we actually KNEW where our money was going! Before we started tracking our expenses with a financial tool, I couldn’t tell you how much money we spent on each category in our budget.īut over time, our family was able to find a financial tool (keep reading to see if it’s Quicken or Mint!) that helped us know our finances inside and out. But finding a program or app that works for you can change the way you view your money. Choosing a personal finance software or app isn’t the most exciting thing in the world. Many people are faced with the same problem: Quicken vs Mint: Who Should You Choose? When it comes to managing your money, there are many personal finance tools that can help you track your expenses, write a budget, and check out your investments – all in one place. You’ll also learn if Quicken is worth the price or if you should just stick with Mint. Member FDIC.Quicken vs Mint – These 2 major personal finance tools have been competing for years! I’m breaking down the difference between Quicken and Mint.

Deposit products and related services are offered by JPMorgan Chase Bank, N.A. "Chase Private Client" is the brand name for a banking and investment product and service offering, requiring a Chase Private Client Checking account.īank deposit accounts, such as checking and savings, may be subject to approval. JPMS, CIA and JPMCB are affiliated companies under the common control of JPMorgan Chase & Co.

Certain custody and other services are provided by JPMorgan Chase Bank, N.A. (CIA), a licensed insurance agency, doing business as Chase Insurance Agency Services, Inc. Annuities are made available through Chase Insurance Agency, Inc. Morgan Securities LLC (JPMS), a registered broker-dealer and investment advisor, member FINRA and SIPC. Morgan Wealth Management is a business of JPMorgan Chase & Co., which offers investment products and services through J.P. Investing involves market risk, including possible loss of principal, and there is no guarantee that investment objectives will be achieved. is a wholly-owned subsidiary of JPMorgan Chase & Co. “Chase,” “JPMorgan,” “JPMorgan Chase,” the JPMorgan Chase logo and the Octagon Symbol are trademarks of JPMorgan Chase Bank, N.A.

0 kommentar(er)

0 kommentar(er)